Is Buying a Condo in Panama City Beach Affordable in 2025?

If you’ve been watching the Panama City Beach real estate market, you’ve probably wondered the same thing one of my YouTube viewers asked me recently:

“Do you have to be a tycoon nowadays to afford one of these condos?”

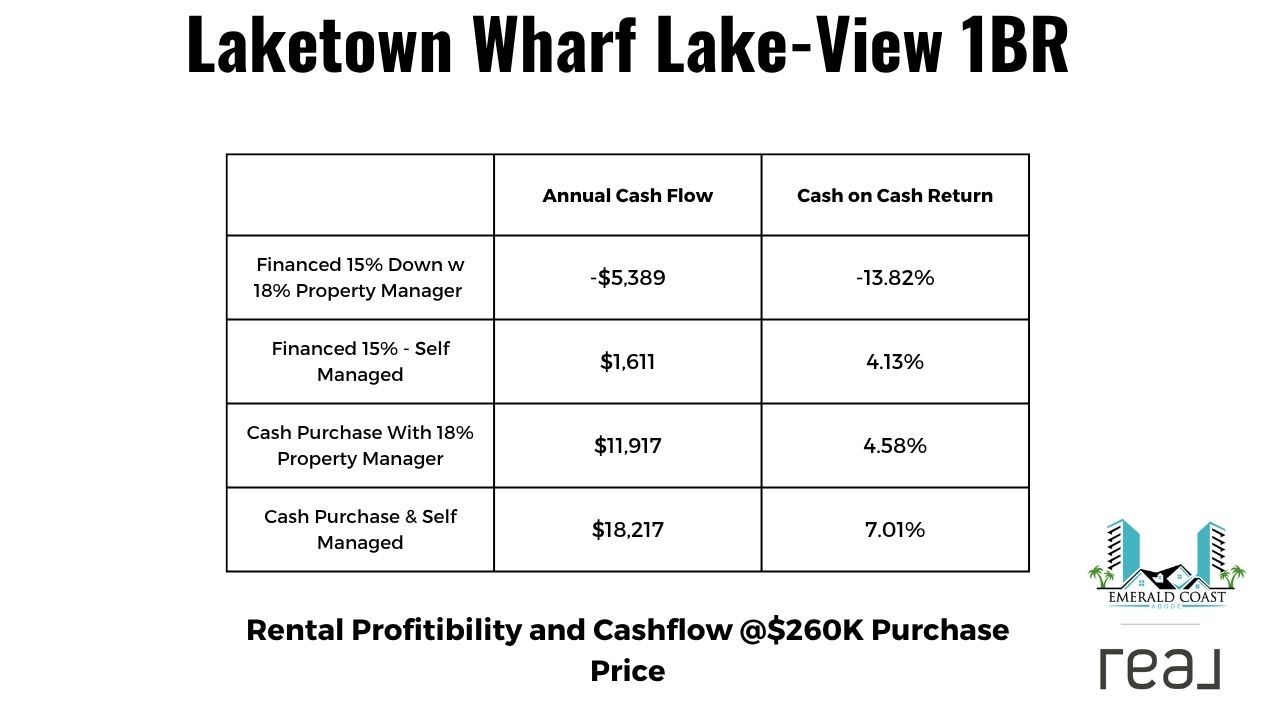

It’s a fair question. Prices, HOA fees, and interest rates all play a role in affordability. To get a real answer, let’s break down the numbers using a Laketown Wharf one-bedroom condo with a lake view, one of the more affordable options on the beach right now. Check out this video for more context:

Laketown Wharf: An Affordable Entry Point

Laketown Wharf is one of the largest condo resorts in Panama City Beach, known for:

-

Five pools

-

Fitness center & dining options

-

Central location across from the beach

-

Competitive pricing compared to direct-beachfront condos

As of late 2024, one-bedroom lake-view units are listed between $250,000 and $270,000. For this analysis, we’ll use $260,000 as the purchase price.

The Real Cost to Own

Here’s a breakdown of monthly ownership costs for a $260,000 Laketown Wharf condo:

-

Mortgage (15% down, 7% ARM): $1,383

-

Property Taxes: $302

-

Insurance: $117

-

HOA Fees: $830 (covers water, sewer, trash, internet, cable, amenities, and master insurance)

-

Electric: ~$150

➡️ Total Monthly Cost: $2,783

That’s your baseline before any rental income.

Rental Income Potential

The Panama City Beach short-term rental market is highly seasonal. Summer months (June & July) can generate double the income of shoulder seasons.

For a Laketown Wharf one-bedroom:

-

Gross Annual Rentals: ~$35,000 (based on 2024 data)

-

After Management (20% fee): ~$28,000

Compare that to annual ownership costs of about $33,000, and you’re short by roughly $5,000/year if you hire a property manager.

How to Make the Numbers Work

There are two main ways buyers in 2025 can avoid negative cash flow:

-

Self-Manage Your Condo

-

Save the 18–20% management fee

-

Potentially turn a small profit (~$1,600/year)

-

Bonus: tax benefits if you qualify as a materially participating operator

-

-

Pay Cash or Put More Down

-

Eliminates or reduces the mortgage expense

-

With cash + self-management, annual cash flow could be $18,000+ (7% ROI)

-

Why Buy If It’s Negative Cash Flow?

So, if condos don’t always cash flow in 2025, why do people still buy?

-

Lifestyle Investment – Many owners want a family gathering place on the beach. If you already spend $4,000–$5,000 a year vacationing here, owning starts to make sense.

-

Long-Term Appreciation - We’re in a buyer’s market right now, with more options than during the COVID boom. Holding long-term can pay off.

-

Tax Benefits – Even with a manager, negative cash flow can offset capital gains at resale.

Owning in Panama City Beach is less about instant returns and more about lifestyle, equity growth, and offsetting costs with rentals.

Final Thoughts: Is It Affordable?

Yes if you go in with the right expectations. In today’s market:

-

A 15% down, financed condo with a manager will likely lose a few thousand per year.

-

Self-managing or buying with cash can make Laketown Wharf and similar condos true cash-flowing assets.

-

Lifestyle value family memories, beach access, and long-term equity often outweigh the short-term financials.

Panama City Beach condos in 2025 aren’t just for “tycoons,” but success depends on how you structure your purchase.

👉 Thinking about buying a condo in Panama City Beach? I specialize in helping buyers analyze rental potential, navigate HOA fees, and find properties that align with both lifestyle and investment goals. Give me a shout if you want to chat:

Categories

Recent Posts